Guide to Setting Up Payroll for Your Child Care Business in Indiana

Francesca Bonnevie

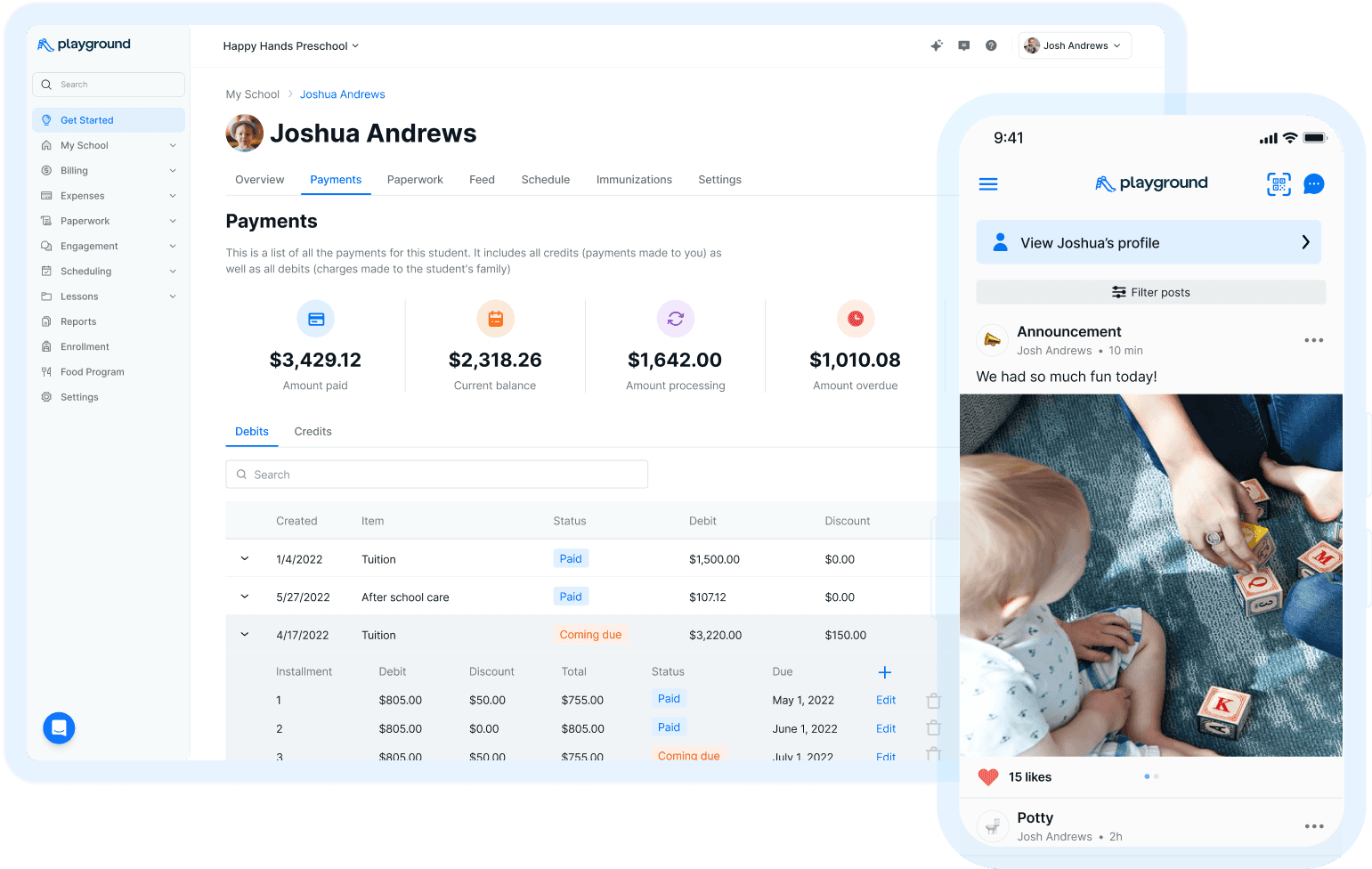

Indiana Provider?

Get Two Years Free.

All-in-one child care management platform with billing, attendance, registration, communication, payroll, and more!

5.0 Rating

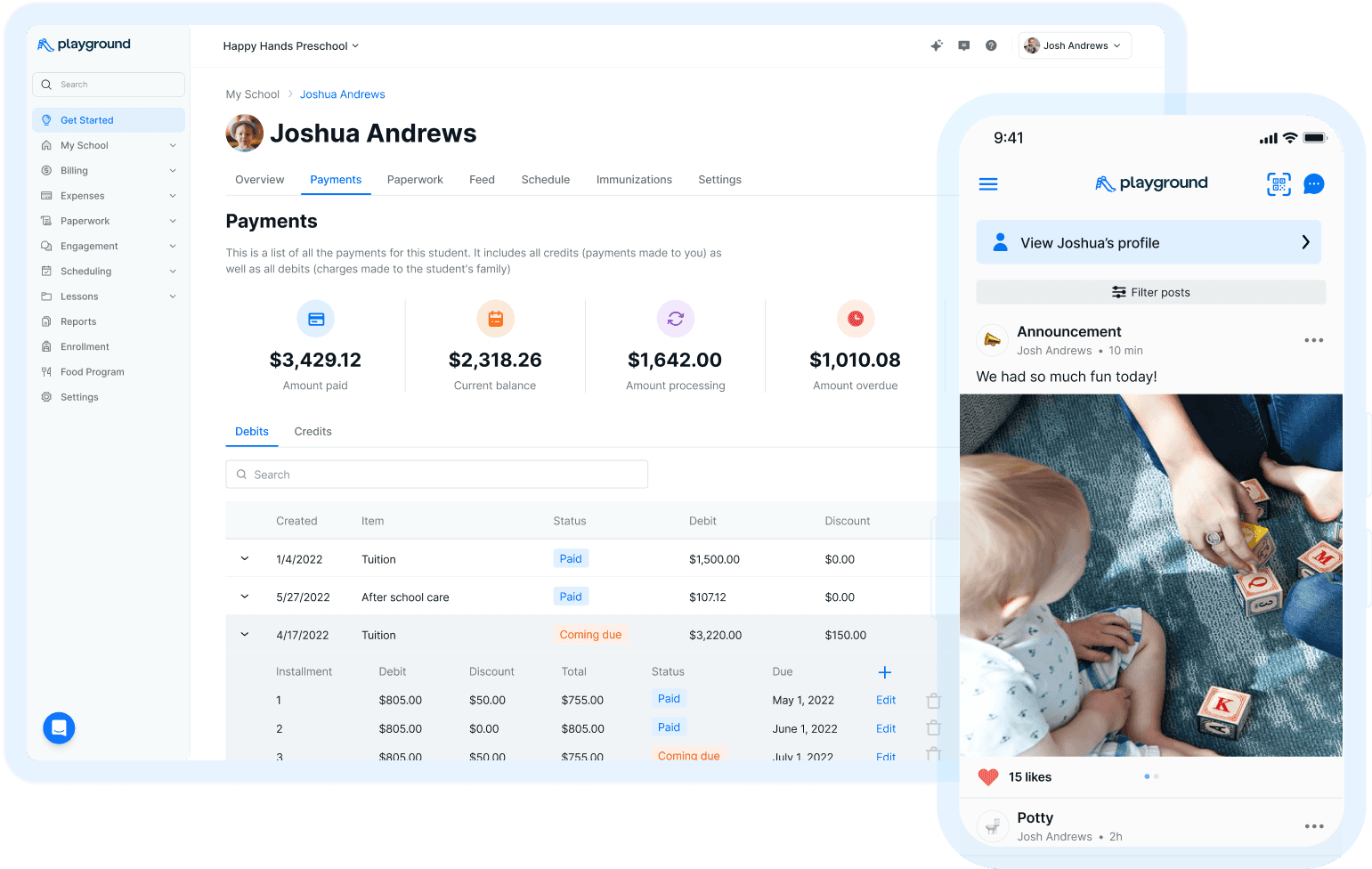

Indiana Provider?

Get Two Years Free.

All-in-one child care management platform with billing, attendance, registration, communication, payroll, and more!

5.0 Rating

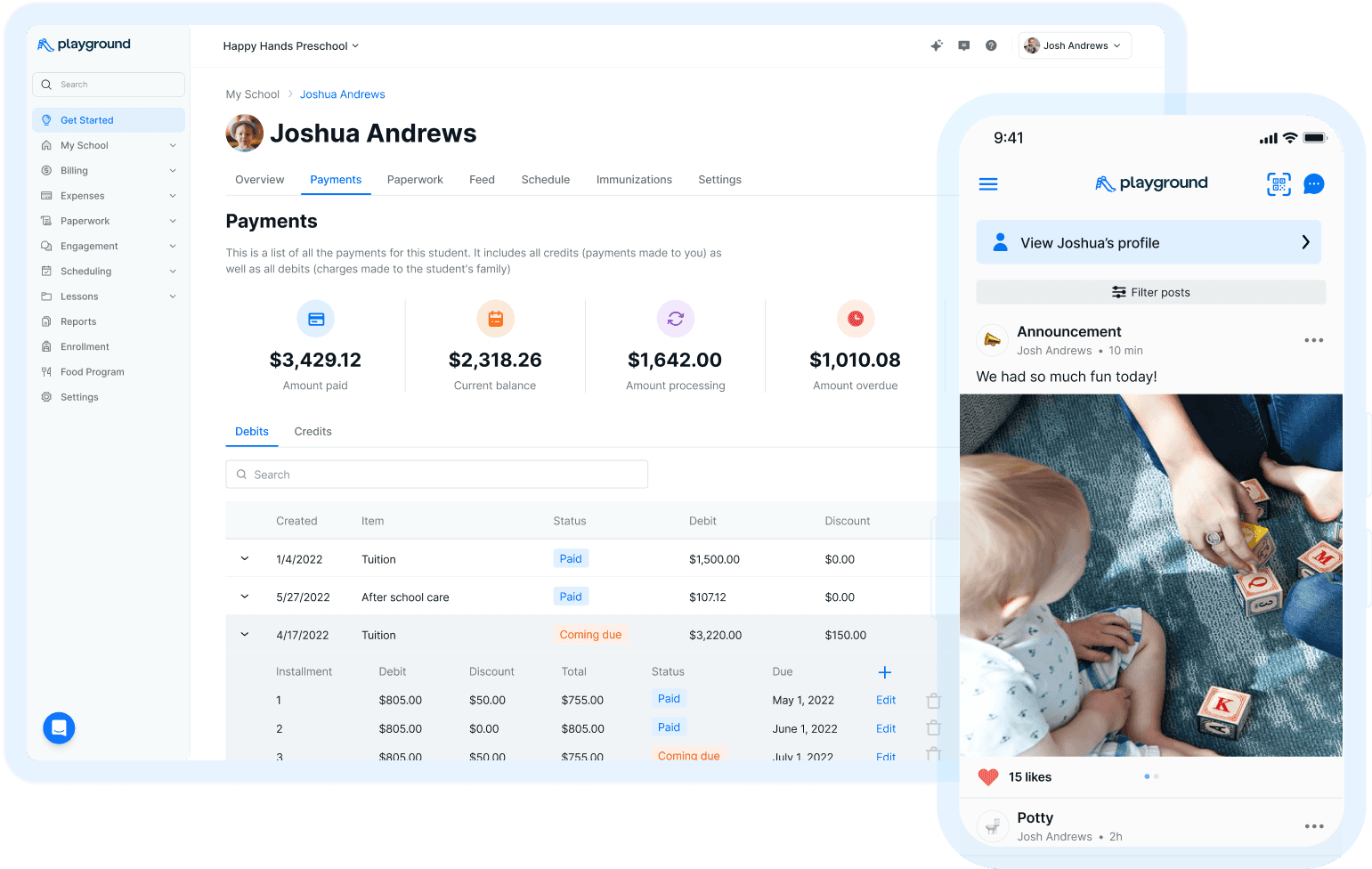

Indiana Provider?

Get Two Years Free.

All-in-one child care management platform with billing, attendance, registration, communication, payroll, and more!

5.0 Rating

Guide to Setting Up Payroll for Your Child Care Business in Indiana

Starting a child care business can be a rewarding venture, but it comes with its fair share of administrative responsibilities, including setting up payroll. Payroll management is crucial not only for ensuring that your employees are compensated accurately and on time but also for maintaining compliance with state and federal regulations.

If you're in Indiana and diving into the child care industry, here's a comprehensive guide to help you navigate the intricacies of setting up payroll for your business.

To get set up with payroll in Indiana, you must provide the following:

Indiana Tax Identification Number

Indiana State Unemployment Tax Account Number

Indiana Employer Tax Rate

Indiana Department of Revenue Power of Attorney

Who needs to pay payroll taxes?

New employers in Indiana that have paid $1 or more to a worker performing covered services within the state need to register with the Employer Self Service (ESS) portal. All entities that have payroll must pay unemployment taxes.

Indiana Tax Identification Number

Your Indiana Tax Identification number is a thirteen-digit number beginning with zero that is formatted as 0XXXXXXXXX XXX.

How to Find Your Indiana Tax Identification Number

There are two ways to find your Tax Identification Number:

On any pieces of mail you’ve previously received from the Department of Revenue.

Contact the Department of Revenue at (317) 233-4016.

Don’t Have a Tax Identification Number?

You can get an Indiana Tax Identification Number by registering online with InBiz. Click Register Now at the bottom of the page and follow the instructions.

You will receive your Tax Identification Number within two to three hours of completing online registration. If you have any questions, contact the Department of Revenue at (317) 233-4016 for more information.

Indiana State Unemployment Tax Account Number

Child care businesses with employees working in Indiana must pay Unemployment Insurance (UI) taxes. In Indiana, UI tax accounts are referred to as SUTA, or State Unemployment Tax Act, accounts. This tax funds unemployment compensation programs for eligible employees.

How to Find Your SUTA Account Number

Your SUTA account number is a six-digit number formatted as XXXXXX. There are three ways to find your SUTA account number:

Log in to your Indiana Uplink Account

On any previously filed quarterly contribution or payroll reports

Contacting the Indiana Department of Workforce Development (DWD) at (800) 891-6499 and selecting option 2

Don’t Have a SUTA Account Number?

You can receive a SUTA Account Number by registering as a new business on Uplink. You will immediately receive your number upon completing the online registration.

Indiana Employer Tax Rate

The Indiana Employer Tax is formatted as a percentage like: X.XX%

The State Unemployment Insurance provides unemployment benefits to eligible workers who become unemployed through no fault of their own (as determined by state law) and meet Indiana’s eligibility requirements.

Employers are required to either pay SUTA contributions or reimburse Indiana for benefit payments, which are then deposited into the Indiana Unemployment Benefit Trust Fund. Funds received from employers are used solely for paying unemployment benefits to qualifying claimants.

How Your Employer Tax Rate is Determined

For new employers and employers restarting Indiana employment after a period of one or more years have a fixed rate of 2.5%.

For employers with three or more years in operation, your rate is determined by unemployment system usage and potential liability for claim filing, ranging from .5% to 7.4% as of 2024.

Your Indiana Employer Tax Rate is determined by several factors and is in effect for a calendar year. More specifically, this is determined using variables such as the number of former employees receiving benefits, the total payroll subject to UI contribution, voluntary payments, and the transfer of all or part of an existing Indiana business.

Missing or inadequate reports, outstanding assessments, unpaid predecessor liabilities, and failure to report mandatory transfers will result in Indiana adding percentage points to an employer’s tax rate, as per the SUTA Dumping Prevention Act. Another cause for tax rate increase is routine failure to respond to the DWD if the failure results in a former employee receiving benefits that they are not eligible for. For further information, see the Indiana Employer Handbook.

How to Find Your Employer Tax Rate

There are three ways to find your Employer Tax Rate:

Log in to your Indiana Uplink account

on the Merit Rate Notice sent to you from the Department of Workforce Development

Contacting the Indiana Department of Workforce Development at (800) 891-6499

Indiana Department of Revenue Power of Attorney (POA) (Form POA-1)

For child care businesses delegating their payroll processing to a payroll software like Playground Payroll, they need to fill out and submit Form POA-1 to the Department of Revenue (DOR). This enables the processor to view account information and correspondence, pay taxes and bills, register tax accounts, file business taxes, and securely message DOR Customer Service.

Playground Payroll users can fill out POA-1 during setup after filling out tax information. You can also complete and submit POA-1 either by uploading an Electronic Power of Attorney (ePOA) on INTIME or by mailing or faxing in a copy of the original paper form

Further Reading

https://www.in.gov/dor/business-tax/

https://www.in.gov/dwd/files/Employer_Handbook.pdf

https://www.in.gov/dwd/files/DWD-ESS-Obtain-SUTA-number.pdf

https://www.paylocity.com/resources/tax-resources/tax-facts/indiana/

Guide to Setting Up Payroll for Your Child Care Business in Indiana

Starting a child care business can be a rewarding venture, but it comes with its fair share of administrative responsibilities, including setting up payroll. Payroll management is crucial not only for ensuring that your employees are compensated accurately and on time but also for maintaining compliance with state and federal regulations.

If you're in Indiana and diving into the child care industry, here's a comprehensive guide to help you navigate the intricacies of setting up payroll for your business.

To get set up with payroll in Indiana, you must provide the following:

Indiana Tax Identification Number

Indiana State Unemployment Tax Account Number

Indiana Employer Tax Rate

Indiana Department of Revenue Power of Attorney

Who needs to pay payroll taxes?

New employers in Indiana that have paid $1 or more to a worker performing covered services within the state need to register with the Employer Self Service (ESS) portal. All entities that have payroll must pay unemployment taxes.

Indiana Tax Identification Number

Your Indiana Tax Identification number is a thirteen-digit number beginning with zero that is formatted as 0XXXXXXXXX XXX.

How to Find Your Indiana Tax Identification Number

There are two ways to find your Tax Identification Number:

On any pieces of mail you’ve previously received from the Department of Revenue.

Contact the Department of Revenue at (317) 233-4016.

Don’t Have a Tax Identification Number?

You can get an Indiana Tax Identification Number by registering online with InBiz. Click Register Now at the bottom of the page and follow the instructions.

You will receive your Tax Identification Number within two to three hours of completing online registration. If you have any questions, contact the Department of Revenue at (317) 233-4016 for more information.

Indiana State Unemployment Tax Account Number

Child care businesses with employees working in Indiana must pay Unemployment Insurance (UI) taxes. In Indiana, UI tax accounts are referred to as SUTA, or State Unemployment Tax Act, accounts. This tax funds unemployment compensation programs for eligible employees.

How to Find Your SUTA Account Number

Your SUTA account number is a six-digit number formatted as XXXXXX. There are three ways to find your SUTA account number:

Log in to your Indiana Uplink Account

On any previously filed quarterly contribution or payroll reports

Contacting the Indiana Department of Workforce Development (DWD) at (800) 891-6499 and selecting option 2

Don’t Have a SUTA Account Number?

You can receive a SUTA Account Number by registering as a new business on Uplink. You will immediately receive your number upon completing the online registration.

Indiana Employer Tax Rate

The Indiana Employer Tax is formatted as a percentage like: X.XX%

The State Unemployment Insurance provides unemployment benefits to eligible workers who become unemployed through no fault of their own (as determined by state law) and meet Indiana’s eligibility requirements.

Employers are required to either pay SUTA contributions or reimburse Indiana for benefit payments, which are then deposited into the Indiana Unemployment Benefit Trust Fund. Funds received from employers are used solely for paying unemployment benefits to qualifying claimants.

How Your Employer Tax Rate is Determined

For new employers and employers restarting Indiana employment after a period of one or more years have a fixed rate of 2.5%.

For employers with three or more years in operation, your rate is determined by unemployment system usage and potential liability for claim filing, ranging from .5% to 7.4% as of 2024.

Your Indiana Employer Tax Rate is determined by several factors and is in effect for a calendar year. More specifically, this is determined using variables such as the number of former employees receiving benefits, the total payroll subject to UI contribution, voluntary payments, and the transfer of all or part of an existing Indiana business.

Missing or inadequate reports, outstanding assessments, unpaid predecessor liabilities, and failure to report mandatory transfers will result in Indiana adding percentage points to an employer’s tax rate, as per the SUTA Dumping Prevention Act. Another cause for tax rate increase is routine failure to respond to the DWD if the failure results in a former employee receiving benefits that they are not eligible for. For further information, see the Indiana Employer Handbook.

How to Find Your Employer Tax Rate

There are three ways to find your Employer Tax Rate:

Log in to your Indiana Uplink account

on the Merit Rate Notice sent to you from the Department of Workforce Development

Contacting the Indiana Department of Workforce Development at (800) 891-6499

Indiana Department of Revenue Power of Attorney (POA) (Form POA-1)

For child care businesses delegating their payroll processing to a payroll software like Playground Payroll, they need to fill out and submit Form POA-1 to the Department of Revenue (DOR). This enables the processor to view account information and correspondence, pay taxes and bills, register tax accounts, file business taxes, and securely message DOR Customer Service.

Playground Payroll users can fill out POA-1 during setup after filling out tax information. You can also complete and submit POA-1 either by uploading an Electronic Power of Attorney (ePOA) on INTIME or by mailing or faxing in a copy of the original paper form

Further Reading

https://www.in.gov/dor/business-tax/

https://www.in.gov/dwd/files/Employer_Handbook.pdf

https://www.in.gov/dwd/files/DWD-ESS-Obtain-SUTA-number.pdf

https://www.paylocity.com/resources/tax-resources/tax-facts/indiana/

Guide to Setting Up Payroll for Your Child Care Business in Indiana

Starting a child care business can be a rewarding venture, but it comes with its fair share of administrative responsibilities, including setting up payroll. Payroll management is crucial not only for ensuring that your employees are compensated accurately and on time but also for maintaining compliance with state and federal regulations.

If you're in Indiana and diving into the child care industry, here's a comprehensive guide to help you navigate the intricacies of setting up payroll for your business.

To get set up with payroll in Indiana, you must provide the following:

Indiana Tax Identification Number

Indiana State Unemployment Tax Account Number

Indiana Employer Tax Rate

Indiana Department of Revenue Power of Attorney

Who needs to pay payroll taxes?

New employers in Indiana that have paid $1 or more to a worker performing covered services within the state need to register with the Employer Self Service (ESS) portal. All entities that have payroll must pay unemployment taxes.

Indiana Tax Identification Number

Your Indiana Tax Identification number is a thirteen-digit number beginning with zero that is formatted as 0XXXXXXXXX XXX.

How to Find Your Indiana Tax Identification Number

There are two ways to find your Tax Identification Number:

On any pieces of mail you’ve previously received from the Department of Revenue.

Contact the Department of Revenue at (317) 233-4016.

Don’t Have a Tax Identification Number?

You can get an Indiana Tax Identification Number by registering online with InBiz. Click Register Now at the bottom of the page and follow the instructions.

You will receive your Tax Identification Number within two to three hours of completing online registration. If you have any questions, contact the Department of Revenue at (317) 233-4016 for more information.

Indiana State Unemployment Tax Account Number

Child care businesses with employees working in Indiana must pay Unemployment Insurance (UI) taxes. In Indiana, UI tax accounts are referred to as SUTA, or State Unemployment Tax Act, accounts. This tax funds unemployment compensation programs for eligible employees.

How to Find Your SUTA Account Number

Your SUTA account number is a six-digit number formatted as XXXXXX. There are three ways to find your SUTA account number:

Log in to your Indiana Uplink Account

On any previously filed quarterly contribution or payroll reports

Contacting the Indiana Department of Workforce Development (DWD) at (800) 891-6499 and selecting option 2

Don’t Have a SUTA Account Number?

You can receive a SUTA Account Number by registering as a new business on Uplink. You will immediately receive your number upon completing the online registration.

Indiana Employer Tax Rate

The Indiana Employer Tax is formatted as a percentage like: X.XX%

The State Unemployment Insurance provides unemployment benefits to eligible workers who become unemployed through no fault of their own (as determined by state law) and meet Indiana’s eligibility requirements.

Employers are required to either pay SUTA contributions or reimburse Indiana for benefit payments, which are then deposited into the Indiana Unemployment Benefit Trust Fund. Funds received from employers are used solely for paying unemployment benefits to qualifying claimants.

How Your Employer Tax Rate is Determined

For new employers and employers restarting Indiana employment after a period of one or more years have a fixed rate of 2.5%.

For employers with three or more years in operation, your rate is determined by unemployment system usage and potential liability for claim filing, ranging from .5% to 7.4% as of 2024.

Your Indiana Employer Tax Rate is determined by several factors and is in effect for a calendar year. More specifically, this is determined using variables such as the number of former employees receiving benefits, the total payroll subject to UI contribution, voluntary payments, and the transfer of all or part of an existing Indiana business.

Missing or inadequate reports, outstanding assessments, unpaid predecessor liabilities, and failure to report mandatory transfers will result in Indiana adding percentage points to an employer’s tax rate, as per the SUTA Dumping Prevention Act. Another cause for tax rate increase is routine failure to respond to the DWD if the failure results in a former employee receiving benefits that they are not eligible for. For further information, see the Indiana Employer Handbook.

How to Find Your Employer Tax Rate

There are three ways to find your Employer Tax Rate:

Log in to your Indiana Uplink account

on the Merit Rate Notice sent to you from the Department of Workforce Development

Contacting the Indiana Department of Workforce Development at (800) 891-6499

Indiana Department of Revenue Power of Attorney (POA) (Form POA-1)

For child care businesses delegating their payroll processing to a payroll software like Playground Payroll, they need to fill out and submit Form POA-1 to the Department of Revenue (DOR). This enables the processor to view account information and correspondence, pay taxes and bills, register tax accounts, file business taxes, and securely message DOR Customer Service.

Playground Payroll users can fill out POA-1 during setup after filling out tax information. You can also complete and submit POA-1 either by uploading an Electronic Power of Attorney (ePOA) on INTIME or by mailing or faxing in a copy of the original paper form

Further Reading

https://www.in.gov/dor/business-tax/

https://www.in.gov/dwd/files/Employer_Handbook.pdf

https://www.in.gov/dwd/files/DWD-ESS-Obtain-SUTA-number.pdf

https://www.paylocity.com/resources/tax-resources/tax-facts/indiana/

Playground is the only app directors need to run their early child care center. Playground manages billing, attendance, registration, communication, paperwork, reporting, and more for child care programs. 300,000+ directors, teachers, and families trust Playground to simplify their lives.

Learn more by scheduling a free personalized demo.

See what Playground can do for you

Learn how our top-rated child care management platform can make your families & teachers happier while lowering your costs

Explore more

Stay in the loop.

Sign up for Playground updates.

Stay in the loop.

Sign up for Playground updates.

Stay in the loop.

Sign up for the updates.

© 2024 Carline Inc. All rights reserved.

© 2024 Carline Inc. All rights reserved.

© 2024 Carline Inc. All rights reserved.

Guide to Setting Up Payroll for Your Child Care Business in Indiana

Published Apr 3, 2024

|